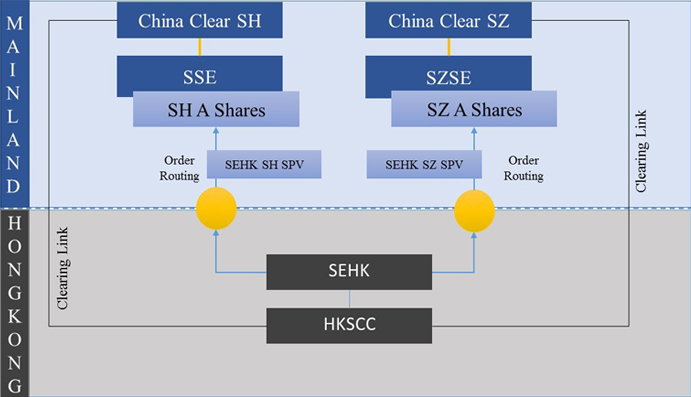

The equity and bond settlements in the Hong Kong market are completed through the Central Clearing and Settlement System (CCASS), hosted by the Hong Kong Securities Clearing Company (HKSCC). Thus, for clearing and settlement in the Hong Kong market, broker back-office systems need to connect to the CCASS. Furthermore, the China Stock Connect (CSC) program has introduced an additional trade channel for Hong Kong investors. The investors can now invest in select stocks (A-Shares) of the Shanghai Stock Exchange and the Shenzhen Stock Exchange though the Northbound Channel of CSC. Since CCASS acts as a central counterparty, on behalf of all Hong Kong brokers, to the clearing houses of Shanghai and Shenzhen, the clearing process becomes smooth for the Hong Kong brokers. Hong Kong brokers, who are granted the direct trading and clearing authority on A-Shares, are the called China Connect Exchange Participants (CCEP), while the other participants, known as Trade Through Exchange Participants (TTEP), can trade A-shares indirectly through any CCEP. China Stock Connect has unlocked a tremendous investment opportunity in mainland markets for Hong Kong investors and eventually, the ability to handle China Stock Connect will become a primary functionality for any Hong Kong broker.

The equity and bond settlements in the Hong Kong market are completed through the Central Clearing and Settlement System (CCASS), hosted by the Hong Kong Securities Clearing Company (HKSCC). Thus, for clearing and settlement in the Hong Kong market, broker back-office systems need to connect to the CCASS. Furthermore, the China Stock Connect (CSC) program has introduced an additional trade channel for Hong Kong investors. The investors can now invest in select stocks (A-Shares) of the Shanghai Stock Exchange and the Shenzhen Stock Exchange though the Northbound Channel of CSC. Since CCASS acts as a central counterparty, on behalf of all Hong Kong brokers, to the clearing houses of Shanghai and Shenzhen, the clearing process becomes smooth for the Hong Kong brokers. Hong Kong brokers, who are granted the direct trading and clearing authority on A-Shares, are the called China Connect Exchange Participants (CCEP), while the other participants, known as Trade Through Exchange Participants (TTEP), can trade A-shares indirectly through any CCEP. China Stock Connect has unlocked a tremendous investment opportunity in mainland markets for Hong Kong investors and eventually, the ability to handle China Stock Connect will become a primary functionality for any Hong Kong broker.

For SEHK Clearing, the connectivity with the CCASS system is the primary milestone. For settlement instructions, CCASS provides a batch-file-based interface option which is widely used by the brokers. Apart from settlement, interfaces to handle Initial Public Offers and Corporate Actions are also critical functions that need to be supported.

The CCASS connectivity required for SEHK and CSC are identical. However, the settlement behaviour of A-Shares are quite different from SEHK stocks. The primary difference is in the settlement cycle. SEHK stocks follow a T+2 settlement cycle, while for A-Shares, the stock settlement is done on T+0 and the cash settlement is done on T+1.

Apart from the settlement cycle, there are certain additional regulatory requirements with which the broker system must comply to handle CSC trades. For example, as the security settlement is on T+0, CSC sell orders are pre-validated for available quantity. Now, to facilitate such pre-checking by the Shanghai and Shenzhen Exchanges, CCASS generates and associates a unique ID to the HK investor’s depository accounts, known as Investor ID. As a compliance requirement, this ID needs to be maintained by the broker and must be sent out with the client order. Also, this ID should be used to determine the settlement location of such trades. From the 3rd quarter of 2018, a new regulation will require all participants to maintain a unique number called Broker-to-Client Assigned Number (BCAN) against each client. This number, along with the Client Identification Number, must be shared with SEHK by each participant. SEHK shares the information with CSC to help them monitor client-level orders for regulatory purposes.

The NRI Financial Solution for Broker-Dealers, referred to as “I-STAR/GV”, is the modern, re-designed and completely re-written version of the Japan-based STAR and I-STAR systems that have been serving a majority of Japanese brokers successfully for several decades. In 2017, NRI introduced “I-STAR/GV for Hong Kong”.

| Timelines, Phases and Deliverables | |

|---|---|

| Core Product Customization – HK and CSC Specific features | 4 Months |

| CCASS Interface Development | 2 Months |

| CCASS Interface – Integration Test | 2 Months |